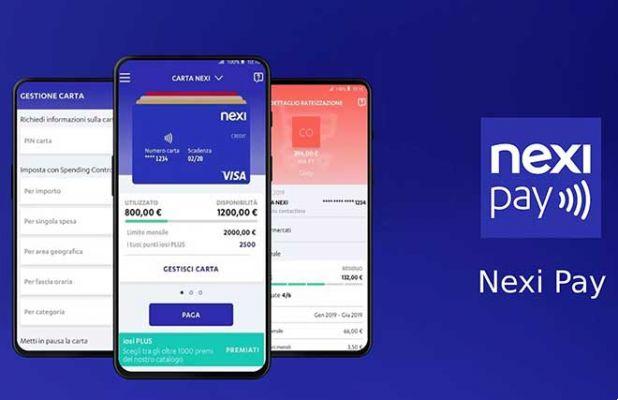

Technology is advancing in all sectors and consequently also in the payment sector with credit and debit cards which periodically acquire new functions that are increasingly useful and performing. In this article we will talk about how it has become easy and practical to manage small payments thanks to mobile payment solutions, such as the Nexi Pay app.

What is Nexy Pay

nexi is one of the largest Spanish companies born from the merger between Cartasì and ICBPI. It specializes in providing digital services allowing you to perform secure payments in traditional shops or online stores using a PC or smartphone.

In this way it is not necessary to carry the cash you need for the payment, on the other hand the future of the purchase is now through the Digital Payment.

Currently the company has also entered the area of micro transactions with the product YAP prepaid card, suitable for young people and students.

The e-wallett is a real virtual electronic wallet that allows you to carry out secure payments through mobile devices. The e-wallet tool stores credit, debit, prepaid or bank account numbers to allow you to make payments in complete safety.

It offers solutions to accept online payments both for the amateur e-commerce site and for the large portal that sells everything online allowing, thanks to the control system adopted, to guarantee maximum security.

It is ideal for ecommerce being able to accept online payments of international circuits from the main wallets such as VISA, VISA-ELECTRON, MasterCard, V-Pay, Maestro, American Express e Diners.

With Bondage Loans Pay it is as if you carry all the cards and online services of your payment card in your pocket. It is also multidevice because it accepts web and mobile payments.

How Nexi Pay works

Bondage Loans Pay it is accepted all over the world. It can be requested at a partner bank or online, by filling out an online form, if you already have a card.

To request the Charter Nexi you must be of legal age, have an account in Spain, be resident in Spain, not be protested and have an annual income.

There are four types of Nexi card: Simple Nexi card, Gold Bonded Charter Charter Nexi Platinum e Carta Nexi Black.

- Simple Nexi card. It has an annual cost of € 35. There is also an additional cost for the cash advance by calculating a maximum commission of 4% with a minimum of € 0,52 for transactions in euros and a minimum of € 5,16 for transactions in other currencies. It is enabled for mobile use. If you want an additional Nexi card, the annual cost is € 25. The statement of account if sent electronically does not involve any additional cost, while if you want it on paper the cost is € 1,15. On bank statements over € 77,47, the government stamp duty is € 2.

- Charter Bonds Gold. It is ideal for ensuring a high availability of spending. It has an annual cost of € 60. The charge will be made on the current account on the 15th of the following month without interest. A 3DSecure service is provided to protect purchases made online. It is possible to consult the balance, the movements, the availability of the various cards and the payment in installments via the App. If you want an additional Nexi card, the annual cost is 40 €. The statement of account if sent electronically does not involve any additional cost, while if you want it on paper the cost is € 1,15. On bank statements over € 77,47, the government stamp duty is € 2.

- Charter Bond Platinum. It has an annual cost of € 120. It provides a high ceiling (from 10.000 to 25.000) and a free policy for all purchases made with the card, medical assistance on travel, baggage coverage and a Cyber Risk policy that protects the professional or company for damage to the computer system and to databases due to hacker or virus raids. In the case of the Nexi Platinum card, the family card is free. If you want an additional card, the annual cost is € 50. On bank statements over € 77,47, the government stamp duty is € 2.

- Black Bonds. For the most prestigious customers, a card has been issued on the Mastercard circuit which has a ceiling of € 25.000 per month and which ensures a series of privileges of the highest level such as the Personal Planner who is a personal assistant always available and the Priority Pass which allows you to access, while waiting for boarding, the airport lounges (protected and comfortable environments) which are oases of peace with sitting areas, armchairs or quiet areas where you can take a nap, taking free drinks and snacks and enjoying many other benefits. The annual cost is € 500 for the first card and € 500 for the additional or family card if required. Card activation is free and can be managed via an App (Nexi Pay App) available for Android and IOS. Once the Nexi Play App has been downloaded from the Google Play Store, the credentials will be requested at the first access. On bank statements over € 77,47, the government stamp duty is € 2.

Services that can be used with Nexi Pay

You have all services under control, from consulting all payment cards to notifications in the App to monitor all purchases in real time. With Nexi Pay it is also possible to top up prepaid cards and mobile SIM cards and register other VISA and Mastercard payment cards.

Still you can consult the rewards catalog of the Nexi loyalty program.

If you are using a mobile phone that recognizes fingerprints, you can access Nexi Pay through this recognition.

Finally, the Nexi Pay card also allows the domiciliation of utilities and periodic payments.

Further Reading:

- The Galaxy A20 screen is not working properly

- IPhone camera not working, how to fix

- The Galaxy A40 screen is not working properly

- How to copy and paste in PuTTY

- How to activate automatic screen rotation on Xiaomi Mi 10T